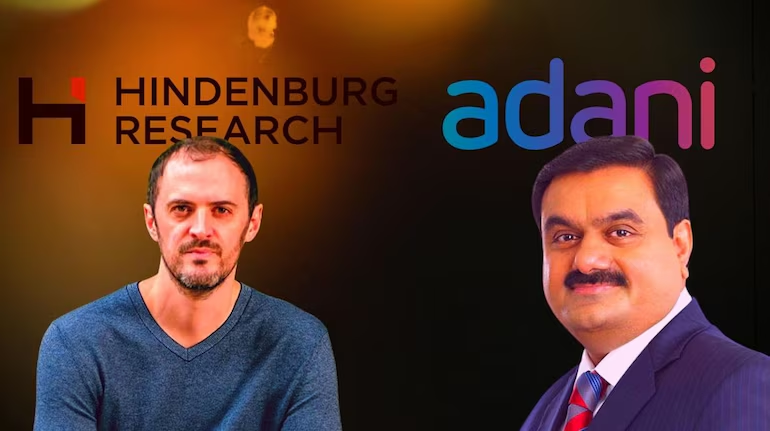

The Adani Group, a sprawling Indian conglomerate led by billionaire Gautam Adani, found itself in the eye of another storm following fresh allegations from U.S. short-seller Hindenburg Research. The Adani Enterprises Share Price tumbled significantly after Hindenburg accused Madhabi Puri Buch, the Chairperson of the Securities and Exchange Board of India (SEBI), of potential conflicts of interest that allegedly hindered a thorough investigation into the Adani Group’s business practices.

Content Overview

The New Allegations ; Adani Enterprises Share Price

On August 10, 2024, Hindenburg Research released a report claiming that both Madhabi Puri Buch and her husband, Dhaval Buch, held investments in offshore funds linked to the Adani Group. The report suggested that these undisclosed interests may have compromised SEBI’s ability to impartially investigate allegations of stock manipulation and corporate fraud that Hindenburg first raised in January 2023. This earlier report had led to a dramatic loss of over $100 billion in market value for Adani’s companies, although they have since regained much of that value.

Hindenburg’s latest report alleges that a company controlled by Vinod Adani, the elder brother of Gautam Adani, invested in the Global Dynamic Opportunities Fund, which then invested in a Mauritius-based fund linked to the Buchs. This connection, according to Hindenburg, casts doubt on SEBI’s impartiality and raises concerns about the integrity of India’s financial regulatory system.

Adani Group’s Response

Adani Group has vehemently denied the allegations, describing them as “malicious, mischievous, and manipulative.” The company insists that its financial and operational structures are fully transparent and in compliance with all regulatory norms. In a statement, Adani asserted that the new allegations are a “red herring” designed to distract from the group’s legitimate business activities and successes.

Madhabi Puri Buch and her husband have also strongly denied the claims, labeling them as baseless and devoid of any truth. They reiterated that all necessary financial disclosures have been made to SEBI over the years and that their finances are “an open book.”

Market Impact On Adani Enterprises Share Price

The immediate market reaction was severe. Adani Group companies lost nearly $2.4 billion in market value on August 12, 2024, as investors reacted to the news. However, the situation could have been worse—the group initially shed as much as $19 billion in early trading before recovering some of the losses by the end of the session. Adani Enterprises, the conglomerate’s flagship company, saw its shares drop by as much as 5% before stabilizing, while other companies in the group, such as Adani Total Gas, Adani Power, and Adani Wilmar, also experienced sharp declines.

Adani shares have shown stability, closing today at ₹1,351.75. This consistent performance reflects a period of steadiness for the company, suggesting a balanced investor sentiment and confidence in its ongoing operations and market strategies. Monitoring future trends will be crucial for assessing long-term stability.

Broader Implications

This latest development in the Adani-Hindenburg saga raises broader questions about the robustness of India’s regulatory framework and the potential impact on foreign investment. If Hindenburg’s allegations are substantiated, it could lead to increased scrutiny of both the Adani Group and SEBI, potentially shaking investor confidence in one of the world’s fastest-growing economies.

Moreover, the situation underscores the growing influence of activist short-sellers like Hindenburg, who continue to challenge some of the world’s largest corporations. For the Adani Group, the stakes are incredibly high as it navigates this complex landscape of regulatory challenges, market pressures, and public scrutiny.

As the story unfolds, it will be crucial to monitor how SEBI responds to these allegations and whether further investigations will be launched. For now, the Adani Group remains resilient, but the long-term impact of these allegations could have far-reaching consequences for both the conglomerate and India’s financial markets.

Conclusion

The ongoing conflict between Hindenburg Research and the Adani Group is far from over. While the conglomerate has managed to recover from previous market shocks, the latest allegations bring new challenges that could have lasting effects. Investors and regulators alike will be watching closely as the situation develops, with the potential for significant repercussions across the Indian financial landscape.

This story is a reminder of the delicate balance between corporate power and regulatory oversight and how quickly that balance can be disrupted by allegations of misconduct. The next steps taken by both SEBI and the Adani Group will be critical in determining the future of this high-stakes saga.

Also Read ; 10 Simple Ways to Improve Your Credit Score

Final Olympic Medal Count: USA Claims Victory in Last-Minute Paris 2024 Showdown

Disclaimer

This blog provides information and insights based on current knowledge and perspectives. We aim to ensure accuracy, but we cannot guarantee that every detail is complete or error-free. Readers are encouraged to seek additional information from official sources and consult experts when needed. We welcome respectful discussion and value diverse viewpoints. The opinions expressed are those of the author and may not reflect the views of all individuals or organizations mentioned. Thank you for your engagement and for being a valued part of our community.